The main alternatives, the mutual funds, are going through a difficult period caused by the international financial crisis. For investments also, the possibilities are limited.

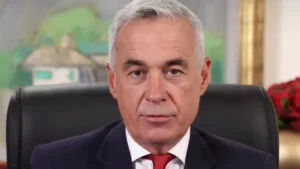

The deposits in lei are the best saving tools at this point, says the university professor Daniel Daianu, former minister of finances."Deposits in lei are the most attractive at this moment. The interests are over the inflation rate, which will settle down towards the end of the year. I don't recommend Romanians to save through the tools of the local capital market (mutual funds) because it lacks depth at this point", said Daianu for EVZ.

Romanians who have extra money, which they want to "put to work", and not keep it under the mattress, have two choices: to save or to invest. In our country, the savings mechanisms are quite few. It's about the banking deposits, mutual funds or state bonds. Good interests at the deposits are those over 10%.

Bancpost offers an interest of 10.5%, bu for minimum 5.000 lei. For deposits between 500 and 1.000 lei, the bank is paying an interest of 7.3%. Another example is Credit Europe Bank which pays a 10% interest for the deposits in the national currency for 12 months, without imposing a larger level than tthat asked or a regular term deposit - 300 lei.

This year, the most performing mutual fund is BCR Obligatiuni, which recorded in 20008 an increase of the background unit value of 5.95%. At the opposite end, the lowest performance was recorded by the share fund Napoca, administrated by SAI Globinvest. It registered a 50.72% drop of the background unit.

The levers the investors are few

Our position on the investments section is weak also. Romanians, especially those with medium incomes, have a reduced number of tools in which to place their money. In the last years, the majority of those who had budgetary "surplus" invested in real estates. A part of them, with a more developed investing culture, placed their money on the capital market also, in financial instruments from the Bucharest or Sibiu Stock Market.

At this moment, BVB is going through very difficult times. This year, the composite index of the market, BET-C, which follows the general evolution of the market, lost 53%. "The Romanian stock market has grown in the past years because on the foreign market was present more liquidities which had to be placed somewhere. This money was guided towards emerging markets, like Romania and Poland", said Daianu. Now, when the world is in full financial crisis, foreign investors, so needed by BVB, have retired, and the consequences are obvious.

"We don't have local investors to compensate the lack of foreign ones on the stock market. More of the Romanian investors are lacking liquidities", added Daianu. The BRD president, Patrick Gelin, went further, making a shock-statement. He said that the Bucharest Stock Market is "almost dieing" and that BVB reached this situation because, until now, it lived only with illusions and on the support of foreign investors. Daianu considers that BVB is not dieing, it's a living organism, which passes through difficult times. It is possible that the foreign investors are waiting to see where the bottom of "the hole" to start to invest again in us.

PLACINGS Real estates, still profitable

Daniel Daianu thinks that real estates are still sure placings. Our situations is much different from that from the Western markets, where this sector is difficult. In Romania, infrastructure is still needed. Those who own land on the path of the future highways or roads will benefit. The cities will expand more in order to air, and the lands near them will be very valuable. "More, I think that the agricultural lands will be a gold mine in the future, in our country", said Daianu.